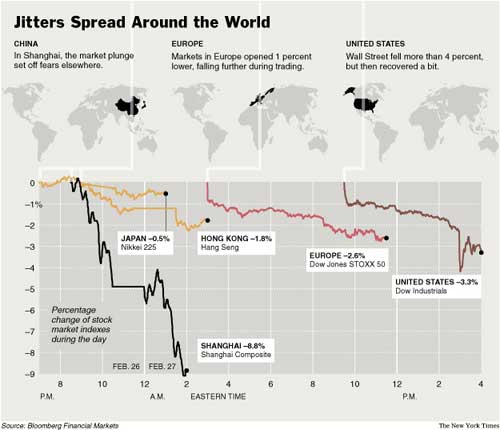

According to Bloomberg potential ‘overheating in China’ lead to about $1-trillion (USD) erased from the value of global equities on Tuesday! The worst one day sell off since 9/11. Wow.

I thought the moment when the computer algorithms started to kick in (around 2.59 pm) was particularly of interest. Many firms have orders queued up in case of downward trending so people don’t lose their shirt. Of course these orders probably trigger more programs to queue up even more orders.

Its fascinating to me that these computer algorithms (used by hedge funds to hide their activity) can have such a major effect on the behaviour of other computer algorithms! Not to mention what happens with computer glitches. I’m not sure how all that works but it was a fascinating day on the market.

Update:

Here is a graphic from the New York Times illustrates this:

New York Times backstory audio on this. Audio mirrored here.